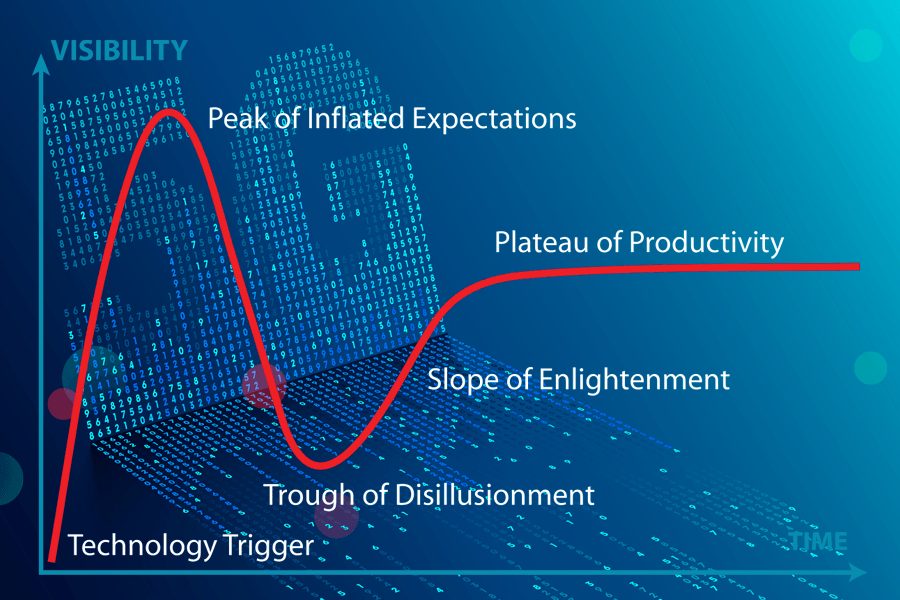

It’s like waiting for the other shoe to drop isn’t it? We hit peak hype curve for a new access technology and then the doubters start to make their voices heard. In the last few weeks there has been a generous scattering of reports and commentary throwing dark and doubtful shadows over the business case for 5G.

Given sluggish smartphone take-up globally and current consumer attitudes to the costs associated with mobile data consumption, doubting the prospects of rapid ROI on 5G investments seems a pretty safe position to adopt. Indeed, recent data from CTIA makes it clear that, in the US, operators are not managing to increase revenue as quickly as data traffic rises, leading some to question the pressure in various countries and regions to make the spectrum and infrastructure investments required to deliver 5G. So maybe the doomsters have got it right?

Well not really. While those that have seen the difficulties faced by the deployment of previous generations may feel faintly comforted in the hype cycle playing out in an ‘ever-thus’ sort of way, in reality it’s difficult to escape the impression this time around there’s an element of ‘fake news’ and misinformation coming from some commentators. I’m not sure anyone directly involved really believed that the 5G business case was either straightforward or, indeed, singular.

Of course, some of the commentary is pertinent; for example, pointing to the urgent need to improve deployment regulation as well as planning and orchestration tools to cut costs and maximise assets in dense networks. And then again some of it is weirdly occult, with a number of people feeling obliged to note that only even number radio iterations (i.e. 2G, 4G) turn out to be successful.

Real Wireless has been interrogating the 5G value proposition for some years. At the beginning of 2018 our techno-economic analysis within the 5G NORMA project pointed to the most likely scenario that there would be little increase in willingness to pay for eMBB – the prime 5G use case for consumers. Commoditisation of data and utility-like margins was the likely mid-term outlook. At some point down the road, consumer scale will undoubtedly be a significant – maybe even the primary – factor shaping the economics of 5G. But it was never going to be the starting point. As our subsequent work on the EU’s MoNArch project confirmed, the new architectures associated with 5G were seeking to reposition based on cloud-oriented techno-economics to address the specific requirements of particular verticals – see, for example, our work with the Port of Hamburg.

Making 5G successful will depend on many factors that, in addition to compelling service propositions, include progressive siting and spectrum regulation, effective virtualisation strategies, the developing role of neutral hosts, the growing adoption of sharing strategies and network aggregation. However, from a user perspective, it’s important to stop talking about 5G as somehow separate from the rest of the connectivity toolbox. At Real Wireless our starting point is never technology but customer requirements. In this context, 5G can take its place with Wi-Fi, LTE and even 2G (see our latest report) as a new asset with huge potential and a business case that comes most vividly to life alongside a broad range of connectivity technologies.

There are bound to be some casualties in the existing wireless industry supply chain in both the vendor and MNO segments as they journey towards interdependence with industry verticals. The trick to sustainability will be patient capital investment in the right digital infrastructure opportunities.

At Real Wireless we have recently launched our new Digital Infrastructure Investment advisory service. Get in touch with us if you would like to know more.